Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

Nigeria's fixed-income market hits a N99.30 trillion valuation as specific Treasury Bill and Bond yields compress due to easing liquidity conditions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Nigeria's fixed-income market hits a N99.30 trillion valuation as specific Treasury Bill and Bond yields compress due to easing liquidity conditions.

GlobTFX is an unregulated broker established in 2024 that currently holds a low safety score of 1.28 on WikiFX due to a lack of valid licensing. Recent user reports indicate severe issues including platform access failures and sudden trading liquidations, specifically impacting clients in North Africa.

President Zelensky reveals US pressure for a Russia-Ukraine war resolution by summer, signaling a potential shift in geopolitical risk premiums affecting the Euro and safe-haven assets.

A detailed review of evest, a forex broker regulated by VFSC and FSCA with a WikiFX score of 5.23. The analysis covers its regulatory status, trading conditions on MT5, and significant user complaints regarding withdrawals and account management.

WikiFX Elite Club Focus is a monthly publication tailored for members of the WikiFX Elite Club, highlighting the key figures, insights, and actions that are genuinely driving the forex industry toward transparency, professionalism, and sustainable development.

On the 3rd of February, Donald Trump signed a funding bill which ended a partial government shutdown that lasted four days. Making this a much quicker resolved shutdown compared to the one we experienced just a few months ago.

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

Crypto has been falling rapidly the past few weeks with no indication of slowing down.

Turkey’s FX market is entering a new phase as KKM ends, inflation pressures persist, and global gold price volatility impacts the lira.

The Bank of England's dovish hold and lowered inflation forecasts have pressured Sterling, highlighting a widening global policy divergence. While the Fed and BoE lean toward easing, improving liquidity metrics signal complex cross-currents for FX traders.

Bitcoin bounces 13% to reclaim $71,000 after a massive leverage flush, highlighting its role as a high-beta proxy for global risk sentiment.

Despite a spike in US jobless claims and layoff headlines, JPMorgan analysis suggests the labor market remains resilient, attributing anomalies to weather and statistical noise. Meanwhile, long-term concerns mount over the Trump administration's aggressive trade agenda for 2026.

As Japan approaches pivotal snap elections, the Yen weakens against major peers, with EUR/JPY reclaiming 185.00. Analysts signal potential FX intervention risks if USD/JPY breaches the critical 160.00 threshold, despite expectations of an LDP victory stabilizing the political landscape.

OW Markets is a Seychelles-regulated entity offering high leverage on MT5, but its low safety score and unresolved complaints about profit deletion raise significant risks. This 2026 assessment highlights critical concerns regarding fund safety and offshore regulatory standards.

Structural strength in gold prices is driving record profitability projections for major producers, serving as a bullish proxy for continued demand in the precious metals market.

The study explores the integration of renewable energy sources into existing power grids, focusing on the technological challenges and economic benefits.

The Nigerian Naira (NGN) strengthened against the Euro to close at N1,606 amid renewed economic optimism, bolstered by a $1.6 billion investment pledge from Dubai-based Maser Group targeting key African markets.

The United States extends trade privileges for African nations through 2026 while China secures a duty-free export deal with South Africa, signaling intensified geopolitical competition and potential support for the South African Rand.

Urgent warning: The **QUOTEX broker** faces multiple regulatory blacklists and a surge of 2025 complaints alleging blocked withdrawals and emptied accounts. Investors are advised that this entity is operating without valid authorization in several jurisdictions.

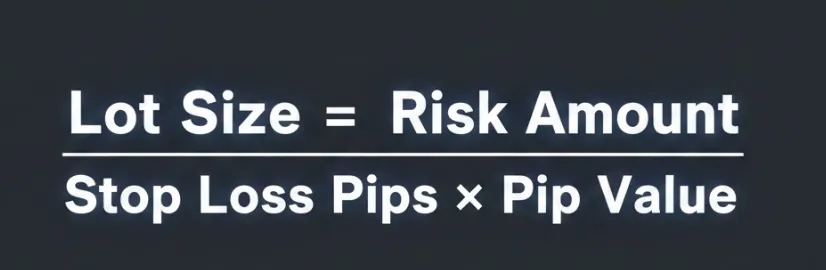

I have watched more traders wash out of this industry in their first year than I can count. Their charts looked distinct, their strategies were different, but their fatal mistake was always the same.