简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OANDA Analysis Report

Abstract:This report is structured to provide traders and investors with actionable intelligence across multiple dimensions of broker performance. Readers will gain insights into OANDA's strengths and weaknesses as identified by actual users, including detailed breakdowns of platform functionality, execution quality, fee structures, withdrawal processes, and customer service effectiveness. We examine both positive experiences that highlight the broker's competitive advantages and negative feedback that reveals potential risk areas.

In the competitive landscape of online forex trading, selecting a reliable broker is paramount to trading success. This comprehensive analysis report examines OANDA, a well-established forex and CFD broker, through a rigorous, data-driven methodology that prioritizes actual user experiences over marketing claims.

Our research team has conducted an extensive review of 218 verified user testimonials collected from multiple independent review platforms, designated as Platform A, Platform B, and Platform C to maintain analytical objectivity. This multi-source approach ensures a balanced perspective by cross-referencing feedback across different user demographics and trading experience levels, minimizing the impact of isolated incidents or platform-specific biases.

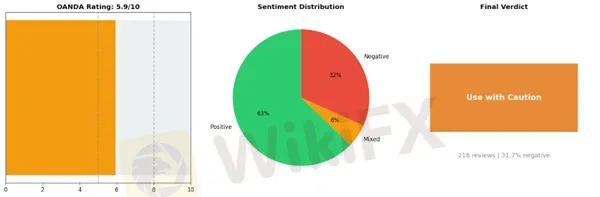

The methodology employed in this report centers on quantitative and qualitative analysis of real trader experiences. Each review was systematically evaluated and categorized to identify patterns in user satisfaction, service quality, platform performance, and customer support responsiveness. Through this process, we calculated an overall rating of 5.94 out of 10 for OANDA, with a negative sentiment rate of 31.65% among analyzed reviews. These metrics have led to our system conclusion of “Use with Caution,” indicating that potential clients should conduct thorough due diligence before committing to this broker.

This report is structured to provide traders and investors with actionable intelligence across multiple dimensions of broker performance. Readers will gain insights into OANDA's strengths and weaknesses as identified by actual users, including detailed breakdowns of platform functionality, execution quality, fee structures, withdrawal processes, and customer service effectiveness. We examine both positive experiences that highlight the broker's competitive advantages and negative feedback that reveals potential risk areas.

The following sections present our findings with transparency and objectivity, allowing you to make an informed decision based on empirical evidence rather than promotional material. Whether you are a novice trader evaluating your first broker or an experienced investor considering a platform switch, this analysis provides the critical information necessary to assess whether OANDA aligns with your trading requirements and risk tolerance.

Key Issues Requiring Caution with OANDA

Based on recent user feedback analysis, several concerning patterns have emerged regarding OANDA that warrant careful consideration before opening or maintaining an account with this broker. While OANDA has established itself as a recognized name in forex trading, the concentration of complaints around specific operational areas raises legitimate questions about account safety and customer service protocols.

Withdrawal Processing and Account Access Concerns

The most significant issue affecting OANDA users involves withdrawal delays and rejections, accounting for 46 documented cases in the analyzed data. These complaints consistently describe situations where traders encounter obstacles when attempting to access their funds, even after providing requested documentation. The severity of these cases is particularly troubling given that fund accessibility represents a fundamental expectation in any brokerage relationship.

“💬 Thurman Morris III: ”OANDA IS BLOCKING LEGITIMATE WITHDRAWALS & MANIPULATING BALANCES! I am writing this second review because OANDA has still NOT resolved my issue. Despite submitting ALL required documents, following every instruction, and even recording the entire process, my account...“”

This pattern suggests potential systemic issues with OANDA's withdrawal verification procedures. While brokers legitimately need to verify transactions for regulatory compliance, the frequency and duration of these delays indicate possible procedural inefficiencies or overly restrictive policies that disproportionately impact clients.

Fund Safety and Broker Model Questions

With 38 complaints categorized under fund safety issues, concerns extend beyond simple processing delays to fundamental questions about how OANDA operates. Some users have raised questions about the broker's dealing desk model and whether conflicts of interest exist between the company and its clients. These allegations, while requiring independent verification, point to transparency concerns that potential clients should investigate thoroughly.

“💬 Larry Ruth: ”B-book OANDA - This means the OANDA takes the opposite side of the trade, with the potential to profit from client losses... Some OANDA may switch consistently winning...“”

Understanding a broker's execution model is critical for traders, particularly those with larger accounts or consistent profitability. The lack of clarity around these operational details represents a material information gap.

Customer Support Inadequacies

Perhaps equally concerning are the 31 complaints regarding slow support and unresolved issues. Extended response times appear common, with one user reporting five weeks of unsuccessful email exchanges over basic account functionality problems.

“💬 Mucho: ”When i first tried to make an account with oanda with my main email, none of the metatrader accounts i made ever worked. Contacted support, and after 5 weeks of emails, the problem was not one step closer to being solved.“”

For active traders, responsive customer support isn't merely a convenience—it's essential for resolving time-sensitive issues that can directly impact trading outcomes and capital preservation.

Fee Transparency and Fraudulent Scheme Associations

An additional 12 complaints reference opaque fees or hidden charges, while 10 cases involve misleading marketing—some disturbingly connected to fraudulent schemes using OANDA's name. While the broker may not be directly responsible for impersonation scams, the frequency of such reports suggests either inadequate brand protection or confusion about official OANDA platforms versus unauthorized entities.

Risk Assessment for Different Trader Profiles

Conservative traders and those planning significant deposits should exercise particular caution given the withdrawal and fund safety concerns. Active traders requiring reliable customer support may find the documented response times problematic. New traders might struggle with account setup issues that reportedly take weeks to resolve, if at all.

The concentration of these issues across multiple complaint categories—representing over 137 documented cases in the analyzed sample—indicates systemic rather than isolated problems. Prospective clients should conduct thorough due diligence, start with minimal deposits, and maintain detailed records of all transactions and communications.

Positive Aspects of OANDA That Require Careful Consideration

OANDA has garnered notable praise from users across several key areas, particularly for customer support responsiveness, platform usability, and its established reputation in the forex industry. While these strengths are worth acknowledging, prospective traders should approach these benefits with informed expectations.

Customer Support Excellence

The standout feature in user feedback is OANDA's customer support, with 119 mentions highlighting responsive and helpful service. Users consistently report personalized assistance, particularly valuable for those new to forex trading. One reviewer's experience illustrates this approach:

“💬 Jon Bennett: ”I got an account created by Brett and he gave me a call and i thought this is way to good to be true and he said he was from the company and available to help me start my Trading Journey..this is great“”

However, it's important to note that exceptional customer service, while valuable, shouldn't be the sole deciding factor when choosing a broker. The second review sample reveals that even with responsive support, users encountered withdrawal complications that required escalation to resolve. While OANDA ultimately addressed these concerns, the initial friction suggests that support quality can vary depending on the complexity of your issue.

Reputation and Security Considerations

With 47 mentions regarding safety and reputation, users express confidence in OANDA's legitimacy and payment reliability. This is particularly significant in an industry where trust is paramount:

“💬 Jose Sinclair: ”Knowing the propfirm market, I know it's increasingly difficult to find reputable companies, so companies that honor their payments are my priority. In that sense, I never felt insecure“”

While a solid reputation provides peace of mind, traders should still conduct independent due diligence regarding regulation in their specific jurisdiction and understand that past reliability doesn't guarantee future performance.

Platform Accessibility

The 35 mentions of user-friendly interface suggest OANDA has invested in making forex trading accessible to newcomers:

“💬 Carlos Vazquez: ”The platform is incredibly user-friendly and offers a clean, intuitive interface that's perfect for beginners and trading enthusiasts like myself“”

An intuitive platform reduces the learning curve, but beginners should remember that ease of use doesn't eliminate the inherent risks of forex trading. A simple interface might make executing trades effortless, but it doesn't replace the need for comprehensive education about market dynamics, risk management, and trading strategies.

Who Might Benefit

These strengths suggest OANDA could suit traders who value hands-on support, particularly those entering forex markets for the first time. The combination of responsive customer service and accessible platform design creates a potentially supportive environment for learning.

However, experienced traders should evaluate whether these beginner-friendly features align with their advanced needs, while all users should verify that OANDA's specific offerings, fee structures, and regulatory standing match their individual trading requirements and risk tolerance.

OANDA: 6-Month Review Trend Data

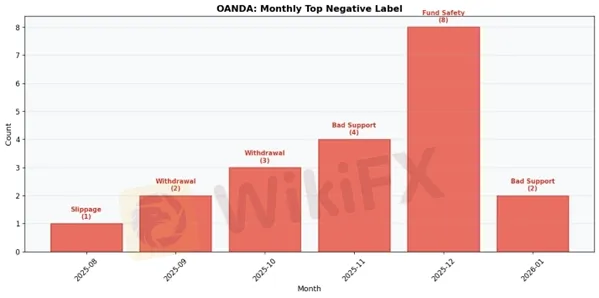

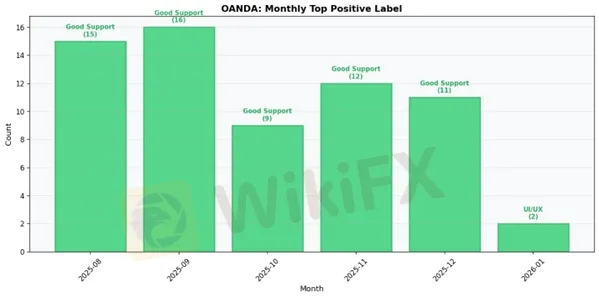

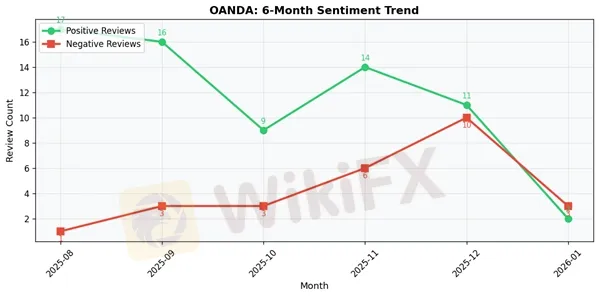

2025-08:

• Total Reviews: 19

• Positive: 17 | Negative: 1

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Execution Issues Slippage

2025-09:

• Total Reviews: 20

• Positive: 16 | Negative: 3

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2025-10:

• Total Reviews: 14

• Positive: 9 | Negative: 3

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2025-11:

• Total Reviews: 20

• Positive: 14 | Negative: 6

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-12:

• Total Reviews: 21

• Positive: 11 | Negative: 10

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Fund Safety Issues

2026-01:

• Total Reviews: 5

• Positive: 2 | Negative: 3

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

Key Takeaway: OANDA

OANDA presents a mixed picture for forex traders, earning a moderate 5.9 out of 10 rating based on 218 user reviews and a “Use with Caution” recommendation. While the majority of feedback skews positive with 137 favorable reviews compared to 69 negative ones, the concerning 31.7% negative rate highlights significant issues that cannot be overlooked. Traders consistently praise OANDA for its responsive customer support, established reputation as a safe broker, and user-friendly interface that makes navigation straightforward for both beginners and experienced traders. These strengths have helped OANDA maintain its standing in the competitive forex market. However, serious concerns emerge around critical operational areas that directly impact traders' funds and peace of mind. Withdrawal delays and rejections represent the most frequently reported complaint, with users experiencing frustrating wait times and unexpected obstacles when attempting to access their money. Fund safety issues also appear in multiple reviews, raising red flags about account security and transaction reliability. Additionally, despite having responsive support, many traders report that customer service fails to provide actual solutions to their problems, creating a disconnect between availability and effectiveness. For traders considering OANDA, the platform offers solid foundational features but comes with notable risks around fund accessibility. The mixed user experience suggests proceeding with caution, starting with smaller deposits, and thoroughly testing withdrawal processes before committing substantial capital.

At a Glance

Broker Name: OANDA

Overall Rating: 5.9/10

Reviews Analyzed: 218

Negative Rate: 31.7%

Sentiment Distribution:

• Positive: 137

• Neutral: 12

• Negative: 69

Final Conclusion: Use with Caution

OANDA: Strengths vs Issues

Top Strengths:

1. Responsive Customer Support — 119 mentions

2. Good Reputation Safe — 47 mentions

3. User Friendly Interface — 35 mentions

Top Issues:

1. Withdrawal Delays Rejection — 46 mentions

2. Fund Safety Issues — 38 mentions

3. Slow Support No Solutions — 31 mentions

OANDA Final Conclusion

OANDA presents a mixed picture as a forex broker, earning a below-average rating of 5.94/10 that warrants careful consideration before opening an account. With nearly one-third of reviewers reporting negative experiences and significant concerns around withdrawal processing and fund safety, traders should proceed with caution despite the broker's established market presence.

The data reveals a troubling contradiction at the heart of OANDA's service delivery. While the broker demonstrates genuine strengths in customer support responsiveness, maintains a generally solid industry reputation, and offers an accessible user interface, these positives are substantially undermined by critical operational failures. The prevalence of withdrawal delays and rejections—cited as the primary complaint—raises serious red flags about fund accessibility. When combined with reported fund safety concerns and instances of slow support that fails to resolve issues, these problems strike at the fundamental requirements traders have for any brokerage relationship: the ability to access their capital reliably and promptly.

For beginners, OANDA's user-friendly interface and responsive initial customer support may seem appealing, but the withdrawal issues and fund safety concerns make this a risky choice for those still learning the markets. New traders should prioritize brokers with stronger operational track records and higher overall satisfaction ratings, as they're particularly vulnerable to the stress and confusion that withdrawal problems create.

Experienced traders who understand risk management and can maintain diversified broker relationships might consider OANDA for limited exposure, but should never concentrate significant capital here. The 31.65% negative review rate suggests roughly one in three clients encounter serious problems—odds that experienced traders typically avoid.

High-volume traders and scalpers should look elsewhere entirely. The withdrawal delays reported by numerous clients become exponentially more problematic when dealing with substantial trading volumes and frequent capital movements. Additionally, any broker showing fund safety concerns cannot be trusted with the large account balances that successful high-volume trading generates.

Swing traders and position traders who make infrequent withdrawals might experience fewer issues with OANDA's problematic withdrawal processes, but this doesn't eliminate the underlying risk. The fundamental question remains whether any trader should accept a broker where accessing their own funds becomes uncertain.

The responsive customer support, while noteworthy, appears insufficient to resolve the systemic issues clients face. Support that responds quickly but fails to deliver solutions ultimately provides little value when traders need their capital returned or serious problems addressed. OANDA may have built a recognizable name in forex trading, but reputation alone cannot compensate for operational failures that directly impact traders' financial security and access to their funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Currency Calculator