Abstract:When choosing a trading broker, every trader asks the same important question: "Will my capital be safe?" To answer this question about ZarVista, we need to look at the facts carefully. While the broker does have licenses, our first look shows that all of its regulation comes from offshore locations. This fact alone creates serious concerns about how well traders are protected. When we look deeper into ZarVista regulation and license details, we find a complicated situation with many warning signs. Read on for more updates.

Understanding How ZarVista is Regulated

When choosing a trading broker, every trader asks the same important question: “Will my capital be safe?” To answer this question about ZarVista, we need to look at the facts carefully. While the broker does have licenses, our first look shows that all of its regulation comes from offshore locations. This fact alone creates serious concerns about how well traders are protected. When we look deeper into ZarVista regulation and license details, we find a complicated situation with many warning signs.

This article gives you a detailed, fact-based breakdown of ZarVista's current status. We won't rely on marketing claims, but on information we can verify. Our research covers three important areas to give you the complete picture:

· The Official Licenses: We will identify what licenses ZarVista holds and, more importantly, where they come from.

· The Company Reality: We will look at the company's registered businesses and check if its claimed physical locations actually exist.

· The User Experience: We will review the many reports from traders who have used the platform, focusing on their experiences with getting their capital back and platform reliability.

Looking at Official Licenses

On the surface, ZarVista presents itself as a regulated company. The company, which has been operating for 5-10 years, lists licenses from two separate offshore financial centers. To understand the broker's regulatory foundation, we must look at each license separately. These licenses make up all of its regulatory claims and are the starting point for any risk evaluation.

The Mauritius FSC License

One of the main licenses held by the broker comes from the Financial Services Commission (FSC) of Mauritius. This license is not held by the main company but by a specific business connected to the brand.

· Licensed Business: Zarvista Capital Markets (MU) Ltd

· Regulator: Mauritius FSC (Financial Services Commission)

· License Type: Securities Trading License (EP)

· License Number: GB23202450

This license places ZarVista within an offshore regulatory environment, a pattern that continues across its company structure.

Comoros MISA Registration

The broker's main registration is located in the Union of the Comoros, a location widely known as a high-risk offshore destination for financial services.

· Registered Business: Zarvista Capital Markets Ltd

· Regulator: Mwali International Services Authority (MISA)

· License Number: T2023293

· Company Address: Moheli Corporate Services Ltd, P.B. 1257 Bonovo Road, Fomboni, Comoros, KM

This registration in Comoros is a major red flag. MISA is known for its seamless requirements and minimal oversight, making it a popular choice for brokers trying to avoid the strict standards of top-level regulators. To give you a clear overview, the following table summarizes ZarVista's regulatory credentials.

This dual offshore licensing strategy is a critical piece of the puzzle. It shows that ZarVista operates entirely outside the protection of any reputable, top-level regulatory body.

The Reality of Offshore Regulation

Understanding what an offshore license from Mauritius or Comoros means for your safety is important. Not all financial licenses are the same, and the difference between a top-level regulator and an offshore one is huge. The “Regulated” status shown by ZarVista is technically true, but the protection it gives traders is very small to non-existent. This is the main reason for the “High potential risk” and “Offshore Regulated” warnings clearly shown on independent review platforms such as WikiFX.

Offshore financial centers are known for low taxes, company secrecy, and, most importantly, loose financial regulation. For a forex broker, this means a business environment with minimal accountability. Let's compare this with the standards set by top-level regulators such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

· Investor Protection Funds: Top-level regulators require that brokers participate in investor compensation programs. For example, the FCA's Financial Services Compensation Scheme (FSCS) can protect client funds up to £85,000 if a broker becomes bankrupt. Offshore locations, such as Comoros and Mauritius, offer no such required compensation funds. If ZarVista goes bankrupt, there is no safety net to help traders recover their funds.

· Enforcement and Oversight: Reputable regulators actively monitor brokers, conduct audits, and enforce strict rules about separating client funds, capital requirements, and fair-dealing practices. They can impose heavy fines, suspend licenses, and pursue legal action. Offshore regulators, by contrast, are known for weak enforcement. Their oversight is often passive, and the rules are far less strict, creating an environment where questionable practices can go unchecked.

· Dispute Resolution: If you have a dispute with a broker regulated by the FCA or ASIC, you can turn to an independent ombudsman service such as the Financial Ombudsman Service in the UK. This provides a clear, impartial, and legally binding process for resolving complaints. For a trader dealing with a Comoros-regulated business, resolving a dispute is extremely difficult. You will likely need to navigate the local legal system of a small island nation, an impractical and expensive task for an international client.

ZarVista's complete reliance on these offshore locations means traders are willingly giving up these critical protections. The licenses serve more as a fake appearance of legitimacy than a genuine commitment to client safety.

Understanding Company Red Flags

Beyond the weak regulatory framework, looking into ZarVista's company structure and physical operations reveals more significant red flags. A legitimate financial services company should have a transparent structure and a verifiable physical presence. ZarVista fails on both counts.

A Network of Companies

The broker's company structure is split across multiple locations, a tactic often used to hide accountability and complicate legal action for clients. We have identified at least three distinct businesses:

· Zarvista Capital Markets Ltd: The main business is registered in the high-risk offshore location of Comoros.

· Zarvista Capital Markets (MU) Ltd: A separate business licensed in another offshore center, Mauritius.

· ZARVISTA SERVICES LTD: A related company registered in Cyprus with registration number HE445683. While Cyprus is a more reputable location, this business does not appear to be the one holding client funds or the primary license. Its exact role is unclear, adding to the companys confusion.

This complicated setup makes it difficult for a trader to determine which business they are contracting with and who is ultimately responsible for their funds.

“No Office Found” Investigations

A broker's physical address is a basic sign of its legitimacy. A company handling millions in client funds should have a real operational base. However, independent field surveys conducted to verify ZarVista's (and its former brand, Zara FX's) listed addresses have yielded alarming results.

· Canada: A field visit to the listed address for Zara FX in Canada found no office.

· Cyprus: A similar investigation at the listed address in Cyprus for ZARA FX also concluded with “No Office Found.”

The inability to verify a physical office is a major warning sign. It suggests that the company may be little more than a virtual business with no substantial presence or staff at its claimed locations. This lack of a verifiable physical presence, combined with the fragmented company structure, paints a picture of a temporary and untrustworthy operation.

This fragmented company structure and lack of a verifiable physical presence are serious concerns. We strongly advise traders to view the complete company history and review the on-site survey reports for themselves on ZarVista's detailed WikiFX profile .

A Pattern of Complaints

Perhaps the most damaging evidence against ZarVista comes directly from the people who have used its services. The broker's low rating on review platforms is not random; it is a direct result of a high volume of severe user complaints. These are not minor complaints about platform speed or spreads; they are serious claims concerning the security of client funds. Looking at the “Exposure” reports reveals a consistent and alarming pattern of behavior.

We have reviewed the core issues reported by traders:

· Severe Withdrawal Problems: This is the most common and critical complaint. Many users report that their withdrawal requests are systematically rejected for vague reasons. In some cases, traders find their funds are simply inaccessible, with some even reporting that the broker's website became unavailable after they attempted to withdraw a significant capital. One neutral review, while praising low spreads, specifically mentions encountering “a couple of declined withdrawals,” confirming that even traders with a partially positive experience face issues getting their funds out.

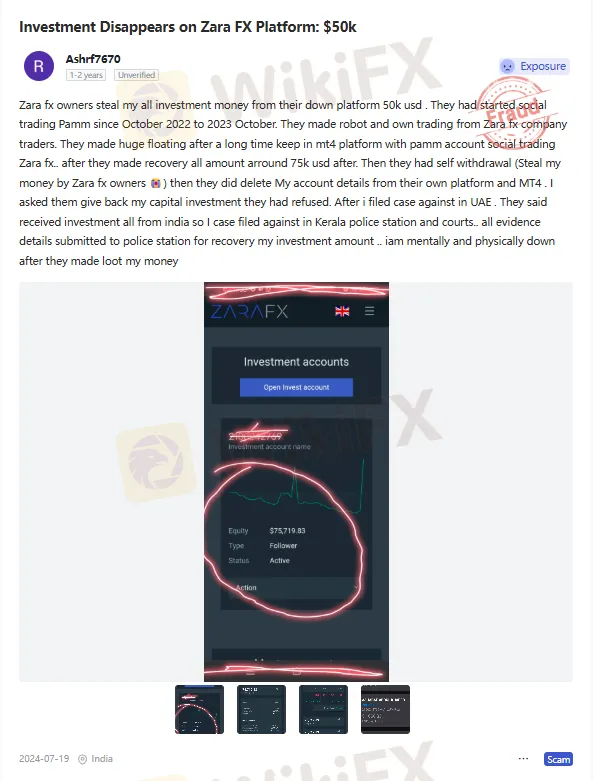

· Claims of Theft and Account Deletion: The most serious complaints involve direct accusations of theft. One trader details losing an investment of $50,000, which grew to a balance of around $75,000. They claim that after the funds were recovered in a PAMM account, the broker itself withdrew the entire amount and then deleted the user's account details from both the client portal and MT4. This user has reportedly filed police reports and legal cases in an attempt to recover their money. Another report echoes this, calling the owners “Real money Stealers.”

Manipulation Claims: Beyond withdrawal issues, there are claims of platform manipulation. One user reported that profits made from manual trading were rejected. The broker allegedly failed to provide any evidence for this rejection and was accused of manipulating platform operations in a way that violated the terms of the MT5 trading terminal itself.

While a few positive reviews exist, praising platform tools or speed, they are vastly outnumbered by these severe complaints. The sheer volume and consistency of reports about withdrawal denial and disappearing funds cannot be ignored. They paint a picture of a broker who may actively prevent clients from accessing their own capital.

The issues reported by users reveal a consistent and alarming pattern. The examples discussed here are just a snapshot. For a complete and up-to-date list of user reviews and exposure reports, it is essential to check the 'Reviews' section on ZarVista's WikiFX page.

The Final Verdict

After a thorough, evidence-based review of ZarVista's regulatory status, company structure, and user-reported experiences, the verdict is clear and unambiguous. Working with this broker presents an extremely high risk to your money. The warning message “Low score, please stay away!” is not an exaggeration but a necessary caution based on overwhelming evidence.

To summarize the key findings of our investigation:

1. Only Offshore Regulation: ZarVista's licenses from Comoros and Mauritius offer minimal-to-no meaningful investor protection, lacking compensation funds, strict oversight, and fair dispute resolution mechanisms.

2. Unclear and Untraceable Structure: The broker operates through a network of companies across multiple locations and, according to on-site investigations, lacks a verifiable physical office. This lack of transparency is a major red flag.

3. Severe and Consistent Complaints: There is a high volume of credible user reports detailing severe issues, most notably the inability to withdraw funds and serious claims of theft and account deletion.

In the world of online trading, regulation is your primary safety net. The evidence clearly shows that the ZarVista regulation framework is insufficient to protect traders. The combination of weak licensing, a questionable company structure, and a track record of severe client complaints makes ZarVista a broker that should be avoided.

Before depositing funds with *any* broker, always perform your research. Verify its current regulatory status, ZarVista license details, and user reviews on a trusted platform. You can find the complete, real-time data and risk analysis for ZarVista by visiting its official page on WikiFX.