BIONM App Promised 15% in Two Months and Cost a Retiree RM1.36 Million

A 70 year old manager has lost RM1.36 million after falling victim to an online investment scam through a mobile app named ‘BIONM’.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

A 31-year-old doctor in Pahang has lost RM285,000 after falling victim to a phone scam syndicate that carefully impersonated multiple authorities to gain his trust.

According to Pahang police chief Datuk Seri Yahaya Othman, the incident began on December 31 when the victim, who works at a hospital in the state, received several phone calls from unknown individuals. The callers first posed as officers from Tenaga Nasional Berhad (TNB), before transferring the call to another person claiming to be a police officer.

The fake “police officer” alleged that the doctor was linked to serious offences, including electricity meter tampering, money laundering and digital fraud. To make the story more convincing, the victim was told that he was under investigation and instructed to stay in constant contact with the suspect, even being asked to report his daily movements.

Over time, the scammers pressured the victim into taking out a loan from a financial institution, claiming the money was required as part of the investigation process. He was then instructed to transfer funds to seven different bank accounts. In addition, the victim was told to purchase 35 Razer Gold top-up cards and hand over the PIN numbers to the suspects.

By the time he realised something was wrong, the damage had already been done. The doctor had lost RM285,000, made up of his personal savings and bank loans. He only became suspicious when the suspects demanded even more money and subsequently became unreachable.

Police have classified the case under Section 420 of the Penal Code for cheating. Authorities have once again reminded the public to be extremely cautious of phone calls involving alleged investigations, especially those that demand secrecy, money transfers or prepaid vouchers.

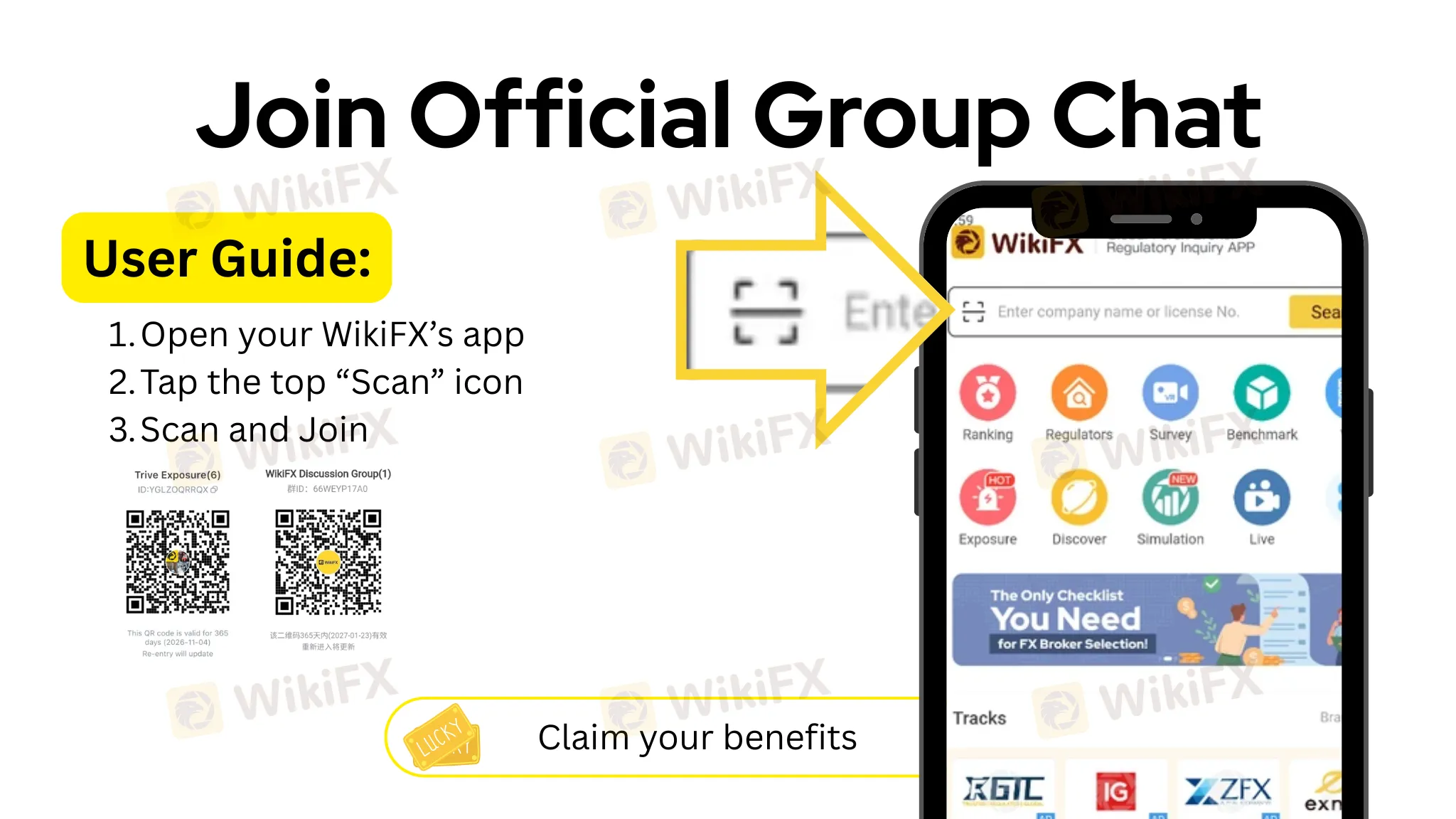

To reduce the risk of falling victim to financial scams, tools like WikiFX can help users verify the legitimacy of brokers and financial platforms before making any investment decisions. By checking regulatory status, risk alerts and user feedback, individuals can better protect their savings and avoid becoming the next target of increasingly sophisticated fraud schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

A 70 year old manager has lost RM1.36 million after falling victim to an online investment scam through a mobile app named ‘BIONM’.

A 45-year-old businessman has lost more than RM1.7 million in an alleged online investment scam.

A Malaysian activist has alleged the emergence of a new scam compound near Myawaddy, Myanmar, dubbed “KK Park 2.0,” highlighting how fraud syndicates may be adapting to regional crackdowns by shifting operations to remote, heavily secured locations.

Artificial intelligence is transforming scam operations across Southeast Asia, enabling criminal syndicates to operate faster, scale wider and evade crackdowns more easily. While authorities step up enforcement, Interpol warns that AI-driven scams are becoming more sophisticated, global and harder to detect, posing growing risks to victims and law enforcement alike.