WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Did you face massive slippage on the GLOBAL GOLD & CURRENCY CORPORATION trading platform and the subsequent reduction in profits? Did the broker apply a stop-loss when you were in profit? Does the high spread only add to your trading losses? Has the broker blocked your trading account and run away with your funds? You are not alone! Many traders have highlighted their painful trading experiences with the Saint Lucia-based forex broker. In this GLOBAL GOLD & CURRENCY CORPORATION review article, we have explained some of them. Read on!

Did you face massive slippage on the GLOBAL GOLD & CURRENCY CORPORATION trading platform and the subsequent reduction in profits? Did the broker apply a stop-loss when you were in profit? Does the high spread only add to your trading losses? Has the broker blocked your trading account and run away with your funds? You are not alone! Many traders have highlighted their painful trading experiences with the Saint Lucia-based forex broker. In this GLOBAL GOLD & CURRENCY CORPORATION review article, we have explained some of them. Read on!

The GGCC, abbreviated for GLOBAL GOLD & CURRENCY CORPORATION, is accused of causing heavy losses to traders through slippage on the trading platform. According to traders, orders are executed way below the target price. Some traders also complain about the triggering of stop-loss orders even when profits were visible on the GLOBAL GOLD & CURRENCY CORPORATION login. Due to slippage quickly eroding their gains, multiple traders have shared their bad trading experiences online. Take a look at them.

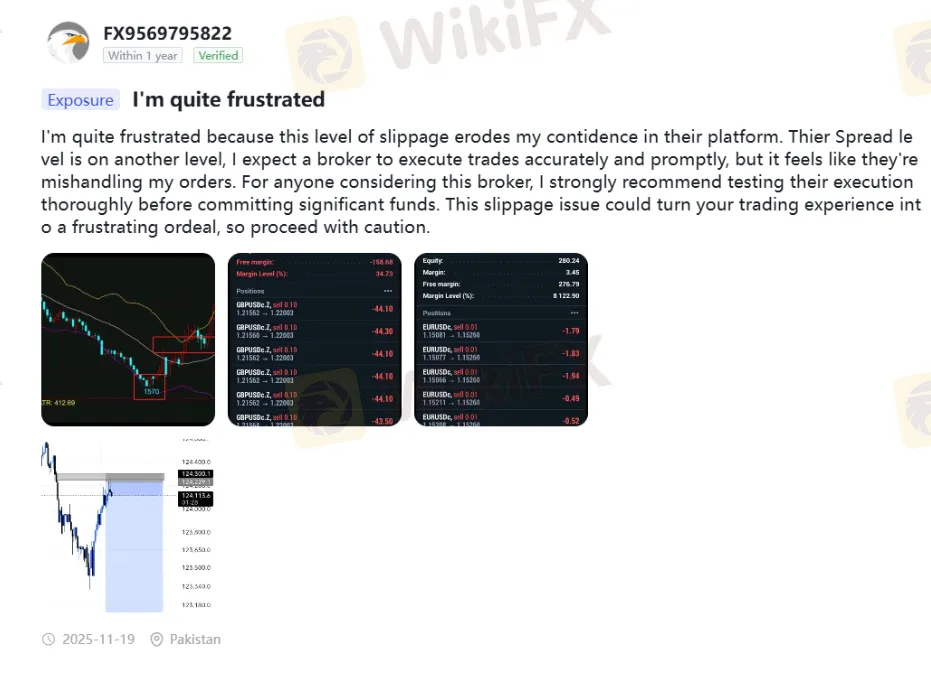

While slippage is an issue affecting traders regularly at GGCC, the high spread charged by the broker does not help them either. Trading costs are alleged to be blown out of proportion, leaving traders with significant losses or a massive reduction in profits. The screenshot below captures the essence of a trader who has almost given up on GLOBAL GOLD & CURRENCY CORPORATION. Take a look!

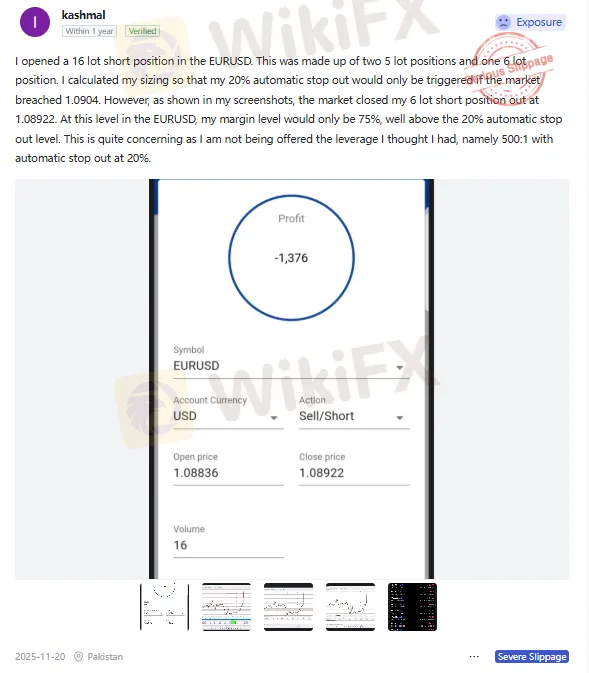

A trader stated to have opened a 16-lot short position on EUR/USD into two 5-lot trades and a single 6-lot trade. Along with that, the position size was made to ensure the triggering of the stop-out order only when the price reached 1.0904. However, as per the attached screenshots below, GLOBAL GOLD & CURRENCY CORPORATION seems to have closed the position early at 1.08922. The trader claimed to have the margin at 75% at this level, which was way above the 20% stop-out threshold. Viewed this as a suspicious trading activity, the trader shared a sharp GLOBAL GOLD & CURRENCY CORPORATION review online. Check below to know more.

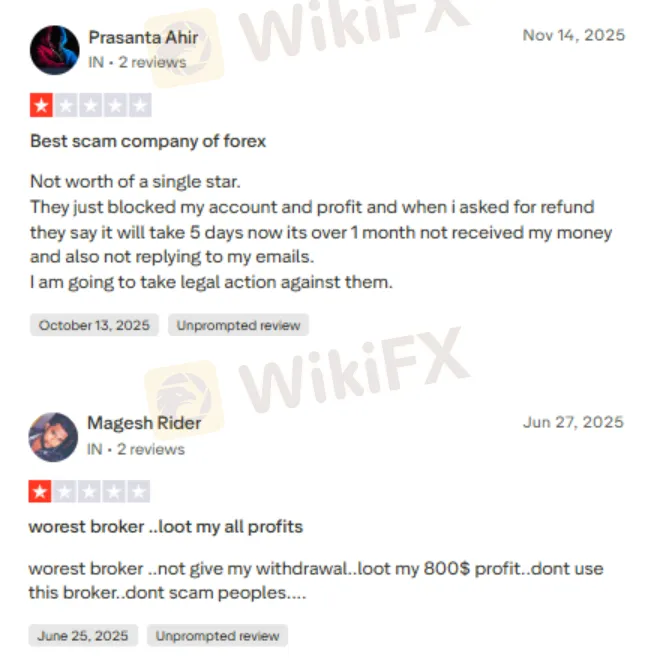

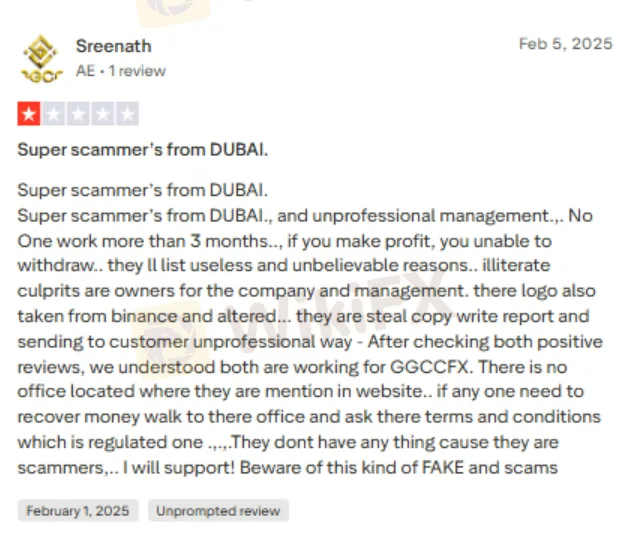

Yes, a broker with severe allegations of slippage and spread, discussed above, will likely make it more difficult for traders by blocking their fund withdrawal access. Multiple traders have raised this complaint online. Let us share some GLOBAL GOLD & CURRENCY CORPORATION reviews on poor withdrawals.

Traders were visibly frustrated after witnessing several instances of trading chaos at GLOBAL GOLD & CURRENCY CORPORATION. After carefully examining the complaints, the WikiFX team investigated the broker’s regulatory status to find out that it was an unregulated entity despite operating for more than two years. With no license, the broker could only merit a score of 1.91 out of 10 from WikiFX.

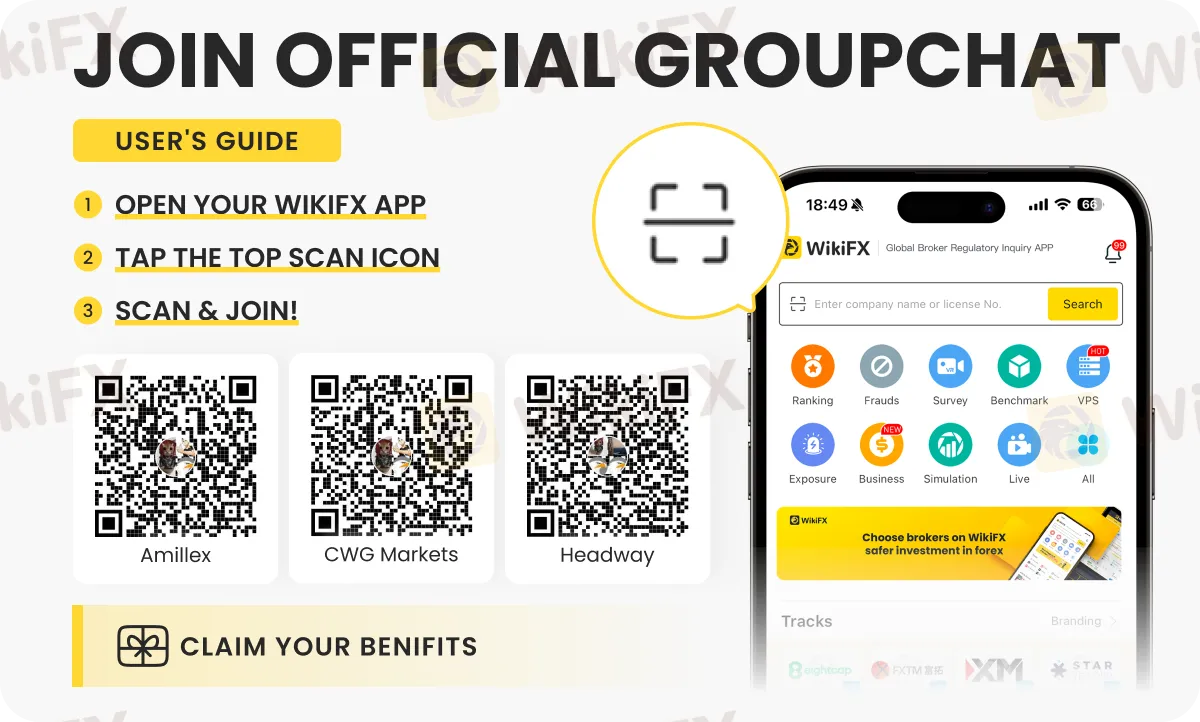

Start exploring forex updates, insights and strategies on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.