Singapore vs Malaysia: Who’s Winning the Scam War?

Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Don’t fall for the trap- stay alert and read on to protect yourself from being looted.

SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Dont fall for the trap- stay alert and read on to protect yourself from being looted.

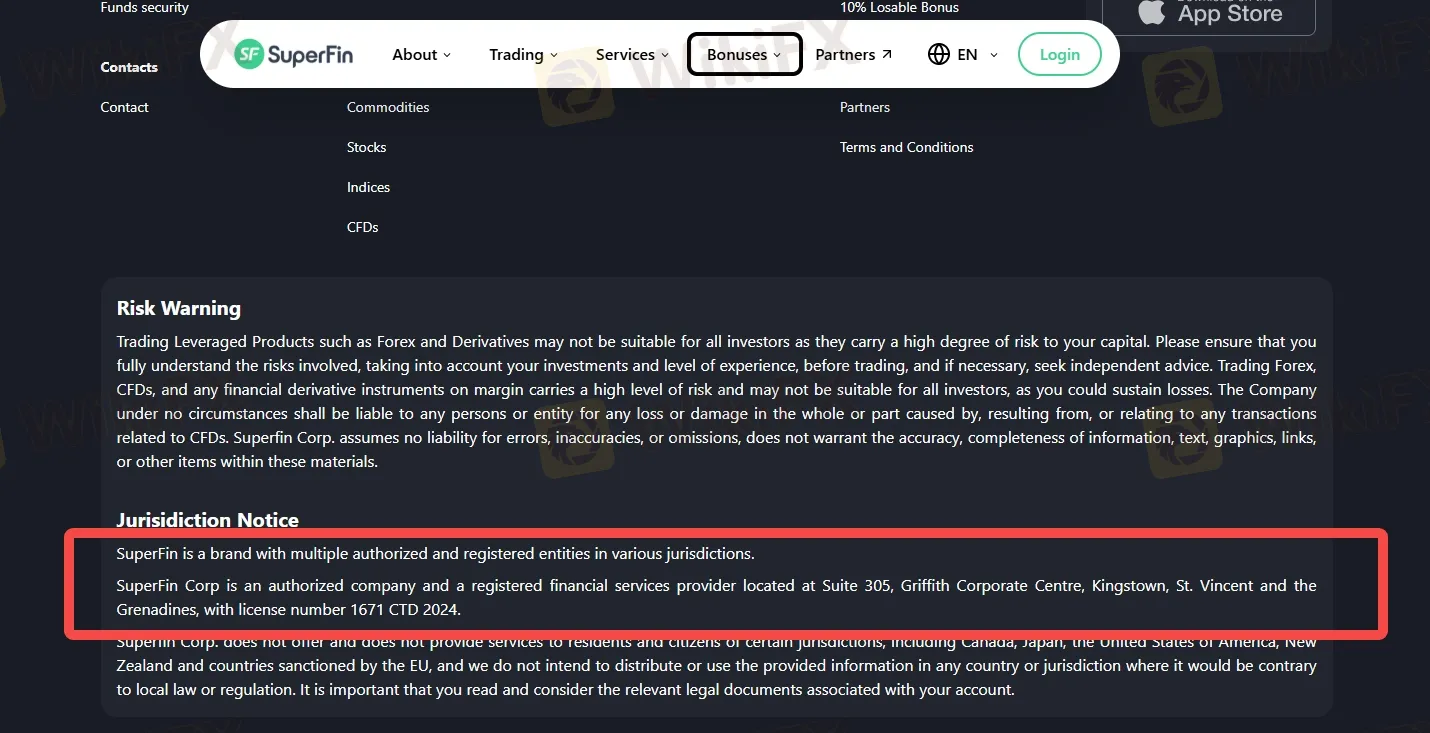

1. Lack of Strong Regulatory Supervision

SuperFin Corp is registered in St. Vincent and the Grenadines and operates under license number 1671 CTD 2024. While this registration gives the company a legal business identity, it's important to note that this offshore jurisdiction is known for its limited investor protection. Unlike brokers regulated by tier-one authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), entities licensed in St. Vincent and the Grenadines are not held to the same rigorous standards of transparency, capital adequacy, or client fund segregation.

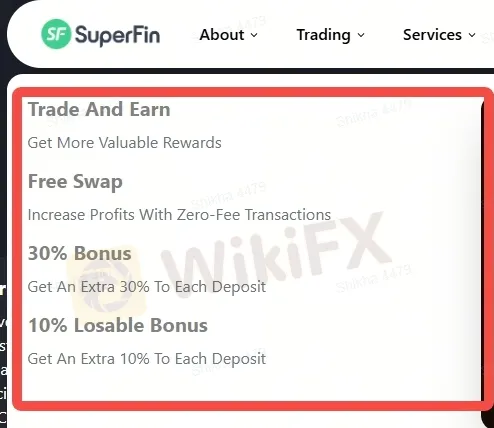

2. Attractive Yet Flashy Promotions

SuperFin aggressively markets itself with bold and flashy promotions designed to attract new traders and retain existing ones. Campaigns like “Trade and Earn” promise valuable rewards, while financial incentives such as a 30% deposit bonus and a 10% losable bonus aim to boost traders capital. SuperFin offers a free swap feature, which allows traders to hold positions overnight without paying swap fees, potentially increasing profitability. However, while these offers may look appealing on the surface, traders should be cautious.

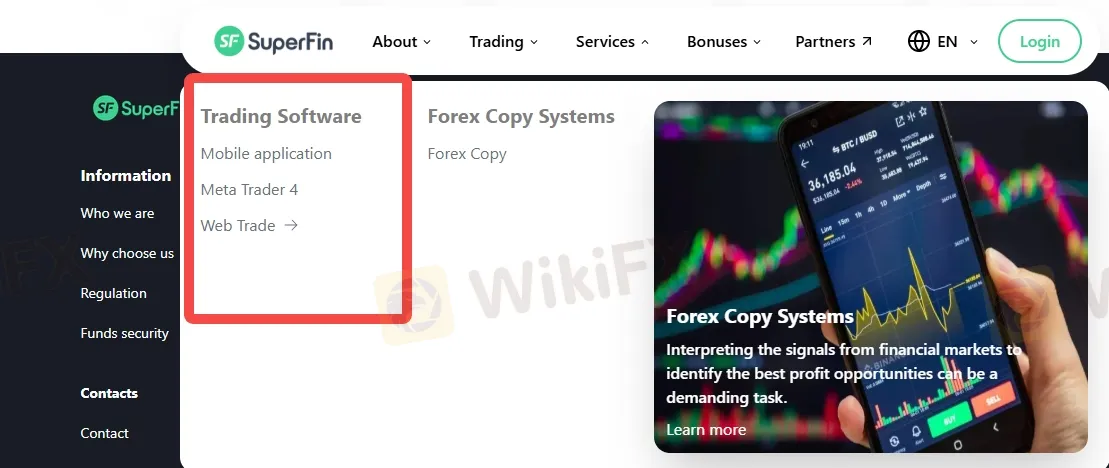

3. Limited Platform Availability

SuperFin currently offers trading exclusively through the MetaTrader 4 (MT4) platform. While MT4 is one of the most widely used platforms in the forex industry, known for its user-friendly interface, advanced charting tools, and automated trading capabilities via Expert Advisors (EAs), it is also somewhat outdated compared to newer platforms like MetaTrader 5 (MT5) or cTrader.

The absence of platform diversity could be a disadvantage for professional or multi-asset traders who expect broader functionality and integration across different devices and asset classes.

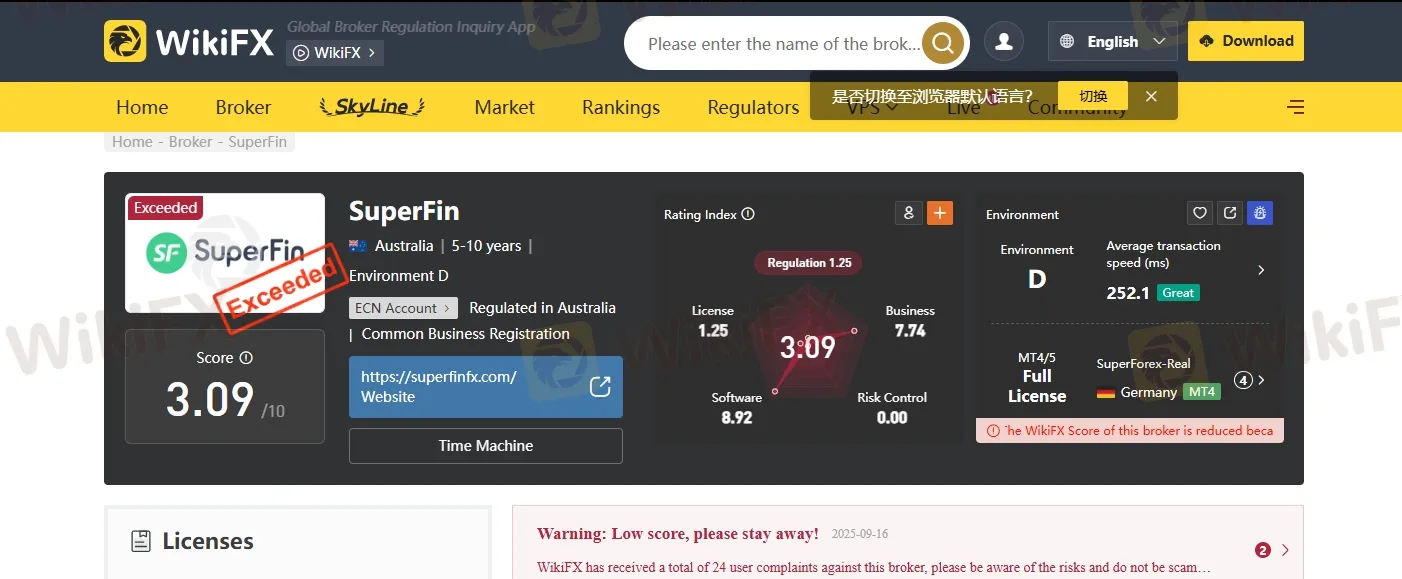

What WikiFX Reveals about SuperFin?

According to WikiFX, SuperFin has received a poor trust score of just 3.09 out of 10, indicating serious concerns about the brokers credibility and overall reliability. WikiFX has also issued an explicit warning against using the platform, stating: “Warning: Low score, please stay away!”

This low rating reflects multiple risk factors, including weak regulatory oversight, questionable transparency, and potentially unsafe trading conditions. For traders seeking a secure and trustworthy trading environment, such a low score should serve as a major red flag and a strong reason to reconsider opening an account with SuperFin.

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!