From CFDs to Crypto: Why Global Brokers Are Moving Deeper into Digital Assets

As regulation matures, brokers are entering crypto at scale. IG Group and Capital.com signal a broader shift toward compliant digital asset trading.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:SEC clarifies no approval for Bitcoin ETFs after a fraudulent post on X platform; investigation underway on the security breach.

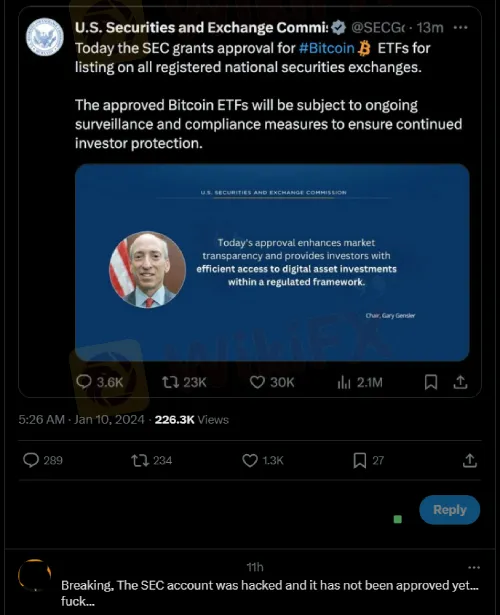

A brief intrusion was reported on the X social media platform by a U.S. securities regulator on Tuesday. The intruder disseminated a fraudulent message purporting to authorize exchange-traded funds (ETFs) for Bitcoin, a development that the cryptocurrency industry had enthusiastically anticipated.

At approximately 4 p.m. Eastern time (2100 GMT), the Securities and Exchange Commission (SEC) disclosed that it has not yet approved spot bitcoin ETFs. Additionally, the SEC's account on X, formerly Twitter, was momentarily compromised by an unidentified entity. The agency stated that “unauthorized access has been terminated.”

Law enforcement will be collaborated with to investigate the breach and “related conduct,” according to the SEC.

X affirmed late Tuesday that the SEC's account had been compromised and stated that it was due to a third party granting an “unidentified individual” access to a phone number associated with the agency's account.

Citing an initial investigation, the social media platform owned by Elon Musk also stated that the SEC had not enabled two-factor authentication at the time the account was compromised and that the breach was not the result of a breach of X's systems.

The fraudulent publication claimed to contain a quotation from SEC Chair Gary Gensler and stated that the SEC had authorized bitcoin ETFs on all registered national securities exchanges. It also boasted an accompanying image. The post, which was taken up by Reuters and other news outlets that monitor the SEC's account, caused an increase in the price of bitcoin.

The SEC was widely anticipated to approve a set of ETFs that monitor the price of bitcoin on Wednesday, marking a potential turning point for the cryptocurrency industry. The posting coincided with this anticipation. Industry insiders scrambled to determine whether the unauthorized post was genuine and why the SEC would initially publish something on social media.

Executives of some ETF issuers expressed shock and astonishment at the initial tweet, speaking on the condition of anonymity due to the sensitivity of the matter.

As a consequence of the breach, one executive expressed “concern” that the SEC might delay or withhold approval for spot bitcoin ETFs.

It was initially unclear, according to two issuers who requested anonymity, whether the breach would affect the approval schedule for spot bitcoin ETFs. Wednesday is the anticipated date of the SEC's judgment regarding a joint proposal put forth by Ark Investments and 21Shares.

Attorney Anthony Tu-Sekine, chief of the blockchain and cryptocurrency division at Seward & Kissel in Washington, stated that at this late juncture, he did not believe the incident would affect the likelihood of approvals.

Tu-Sekine stated that it was puzzling as to why an individual would take such a course of action when the endorsement was already widely anticipated. “This is puzzling,” stated Tu-Sekine.

SPIKE IN PRICE STORM

The post on the SEC's X account had garnered a minimum of one million views as of 4:11 p.m. ET. After less than twenty minutes, it ceased to be visible and seemed to have been removed.

The fictitious statement caused the price of Bitcoin to surge to approximately $48,000, before plummeting to below $45,000 minutes later. It was last trading at $45,513 after the SEC disowned and deleted the information, a decrease of 3.15%. Certain analysts had anticipated a decline in bitcoin in response to the ETF approvals, given that the cryptocurrency had risen by over 70% in recent months on the anticipation of a greenlight.

The SEC declined to comment on whether an investigation into the compromise has begun or whether potential approvals will be impacted as a result of the incident. In the past, the SEC has rejected every spot bitcoin ETF proposal on account of concerns regarding market manipulation.

Similar to other social media platforms, X accounts are occasionally compromised through the theft of passwords or the deception of targets into divulging their login credentials.

Additionally, accounts may be compromised through a breach of the social media platform itself. An adolescent hacker and his companions, for instance, breached X's internal computer network in 2020 and acquired control of dozens of prominent accounts to promote a cryptocurrency hoax.

Affected at the time were accounts associated with Elon Musk, Barack Obama, Kim Kardashian, and Jeff Bezos, among others.

A request for comment was not met with a response from a representative of X.

“To stay informed about global affairs, we have become reliant on this instant social media sensation,” said James Angel, an associate professor at the McDonough School of Business at Georgetown University. “We're going to be more and more vulnerable to this kind of instant misinformation.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As regulation matures, brokers are entering crypto at scale. IG Group and Capital.com signal a broader shift toward compliant digital asset trading.

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

Celebrity names and crypto hype have become powerful tools for investment scammers. By exploiting trust, urgency and the promise of quick wealth, fraudsters lure victims into sophisticated schemes that display fake profits and demand endless fees. The lesson is simple: visibility and fame do not equal legitimacy — only independent verification does.

Crypto has been falling rapidly the past few weeks with no indication of slowing down.