WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

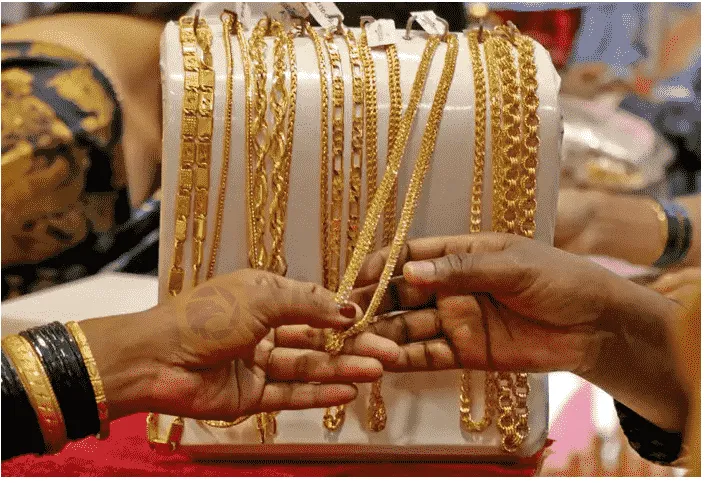

Abstract:India’s gold demand in the first half of 2022 jumped 42% from a year ago but consumption in the second half could be lower than last year as higher inflation erodes disposable income, the World Gold Council (WGC) said on Thursday.

Lower purchases by the worlds second-biggest gold consumer could weigh on prices, which are trading near their lowest level in more than a year.

But falling demand for gold imports could help narrow Indias trade deficit and support an ailing rupee.

“Inflation is making it difficult for people, especially in rural areas, to save more and allocate to gold,” Somasundaram PR, regional chief executive officer of WGCs Indian operations, told Reuters.

India‘s annual inflation rate in June remained painfully above the 7% mark and beyond the central bank’s tolerance band for the sixth month in a row, raising the prospects for more rate hikes by the central bank next month.

In the short-term, the rise in local gold prices because of a depreciating rupee and increase in import duty on the bullion will also hurt demand, he said.

Indias demand for gold jumped 43% from a year ago to 170.7 tonnes in the quarter through June as jewellery sales improved because of weddings and the annual Hindu and Jain holy festival of Akshaya Tritiya, when buying gold is considered auspicious, the WGC said in a report published on Thursday.

In the first half of 2022, gold consumption rose 43% to 306.2 tonnes.

The WGC earlier estimated Indias gold consumption in 2022 at 800-850 tonnes, but the likely slowdown in demand in the second half prompted it to scale down that estimate to the lower end of that range at around 800 tonnes.

Higher prices prompting some Indian consumers to liquidate their holdings, which could lift scrap supplies in 2022 above 100 tonnes from 75.2 tonnes a year ago, Somasundaram said.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.