WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

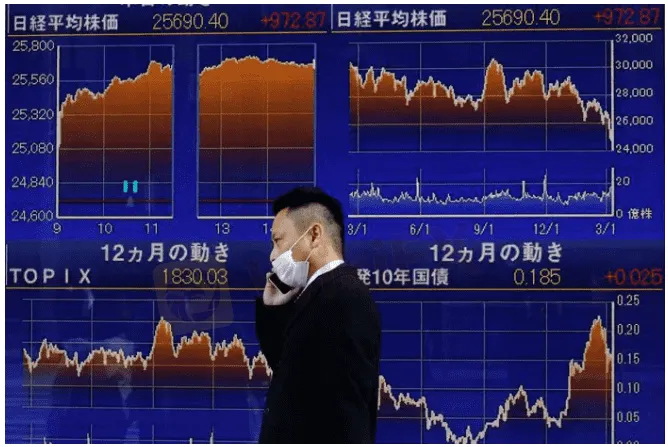

Abstract:Asian shares traded cautiously on Tuesday, with investors weighing Chinas measures to cushion an economic slowdown and the prospect of aggressive Federal Reserve monetary policy tightening.

U.S. stocks surged Tuesday on the back of stronger than expected corporate earnings, but bleak forecasts on global economic growth pushed up bond yields and drove down oil.

The tech-heavy Nasdaq led the way for gains in U.S. markets, as many corporations began to report stronger than expected earnings. Those reports helped investors shake off warnings from global forecasters of a slowdown in economic growth, which weighed on other sectors like bonds and oil.

Of the 49 companies in the S&P 500 that have reported quarterly earnings as of Tuesday, nearly 80% have topped profit estimates, per Refinitiv data.

The Dow Jones Industrial Average rose 1.45%, the S&P 500 gained 1.61% and the Nasdaq Composite jumped 2.15%.

The MSCI world equity index, which tracks shares in 45 nations, was up 0.81%.

The surge came even as global economic bodies began to air warnings on economic growth. Both the World Bank and the International Monetary Fund slashed their global economic outlooks for 2022 by nearly a full percentage point, citing turmoil emanating from Russias invasion of Ukraine and the pitched battle against inflation worldwide.

The current battle by central banks worldwide to curb inflation continued to boost bond markets, where U.S. Treasury yields continued to move upward.

GRAPHIC: U.S. dividend yield vs UST https://fingfx.thomsonreuters.com/gfx/mkt/zjvqkmqgmvx/US%20dividend%20yield%20vs%20UST.JPG

The Federal Reserve looks set to raise its interest rate by 50 basis points when it meets next month and a 75 basis-point hike has not been ruled out as Fed officials scramble to curtail inflation.

St. Louis Federal Reserve President James Bullard repeated his case for raising rates to 3.5% by the year-end on Monday, adding a 75 basis-point hike should not be discounted, although this was not his base case.

“There is growing speculation the Federal Reserve will look to ramp up the rate it is tightening its monetary policy,” said David Madden, market analyst at Equiti Capital. “US bond yields are moving higher at a fast rate.”

The benchmark 10-year Treasury yield was last at 2.942%, down slightly after hitting its highest levels in three years.

The dollar index rose above 101 for the first time since March 2020, as the greenback hit a 20-year high against the yen and tested a two-year peak on the euro. The index was last up 0.2% to 100.986.

Growth concerns weighed on oil markets Tuesday, reversing recent gains in the commodity amid some concerns about global supply.

Brent crude was down 5.35%, at $107.11 a barrel. U.S. crude was down 5.34% at $102.43 per barrel.

Gold prices were lower after coming close to reaching $2,000 an ounce during Mondays session. Spot gold fell to $1,948.31 an ounce, down 1.52% for the day.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.